What's the Minimum Credit Score for a Home Loan?

Table of Content

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Our guide below discusses front end & back end limits for various loan types, as well as how the CFPB proposed shifting from DTI ratio to using loan pricing info for loan qualification. Keep in mind, too, that many down payment assistance programs have income limits. Typically, your income cannot exceed 100% to 115% of the median area income. This involves your employer providing written confirmation. Apply at young age – If you age at the time of applying is in early 30s or late 20s.

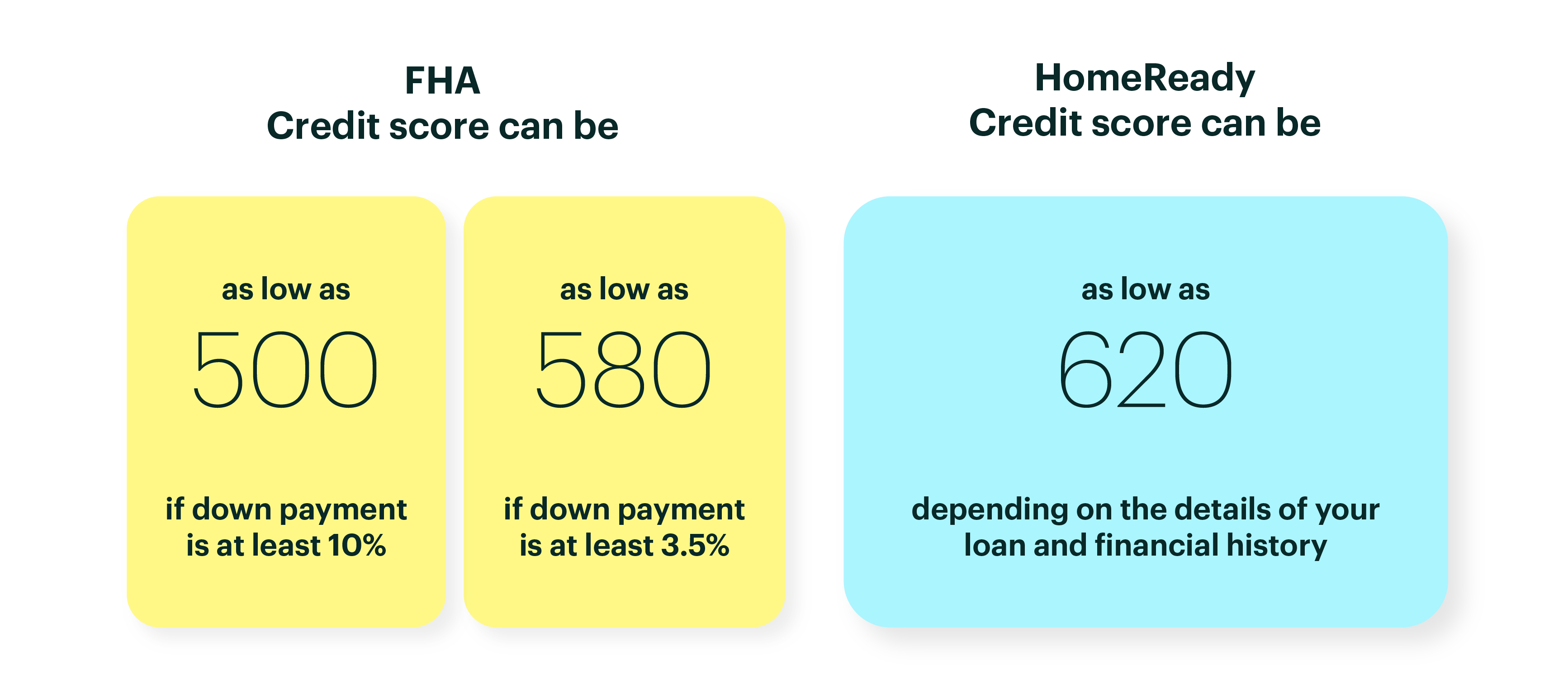

Conventional mortgage guidelines require a minimum credit score of 620. You’ll snag the best mortgage rates and lower PMI premiums with credit scores of 740 or higher. Conventional loans, which remain the most popular mortgage option, aren’t guaranteed by any government agency. Learn how personal loan interest rates work, how rate types differ, and what the average interest rate is on a typical personal loan. One is that it makes it difficult for some homeowners—and particularly those who don’t yet own significant equity—to access a home equity loan.

Home Loan Income Qualification Calculator

We’ll walk you through what defines a small mortgage loan, how to find one and why it can be difficult to secure one. We’ve also compiled a list of alternatives so that you can decide what loan type is right for you and your finances. If your credit score is low and you wish to get approved for a Home Loan quickly, consider applying for a Home Loan amount lower than what you had planned to apply for. Choose a shorter tenure – For long term loans, though the EMI is less, the overall cost of the loan drastically increases because you are paying interest for a longer period of time. So, choose shorter tenures as the interest amount will get much lower with time. Use a home loan EMI calculator while comparing long-term and short-term home loans.

There are options for homebuyers who have fallen in love with a property that has one of these potentially deal-killing problems. Thinking about buying but not sure where to begin? A land contract can help you buy a home if you don’t qualify for a traditional loan. Once the details have been fed, you can click on the ‘Calculate’ button to get a detailed breakup of your loan including the amount payable towards interest.

How does my county loan limit affect me?

Is it mandatory to have a co-applicant while applying for a home loan? Although there is no mandate for having a co-applicant for a home loan in India, most of the lenders insist on having one to ensure the guarantee in regard to the repayment of the loan amount. In addition to that, having a co-applicant while applying for a home loan will also boost your home loan eligibility. Nevertheless, it should be kept in mind that there is no legal requirement for having a co-applicant when applying for a home loan.

Instead of getting a loan that requires your home as collateral, you could try qualifying for a personal loan. Just keep in mind that without collateral, your interest rate may be much higher. When you shop around for your mortgage, you may need to check out several different types of lenders, not just big banks.

Eligibility

So, you don’t have to put down 20 percent, but should you? That answer depends on a number of factors, but the most important is your own bank account. If you are sitting on plenty of cash and putting down 20 percent won’t stress your finances, it’s a good move to avoid costly mortgage insurance payments. However, if a 20 percent down payment will drain most of your bank account, you’ll want to think twice.

A second mortgage is a mortgage made while the original mortgage is still in effect. Learn the requirements for a second mortgage and how to apply. Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture. Select independently determines what we cover and recommend.

Why do lenders have minimum mortgage amounts?

Your annual income must be reliable and stable, too. So you need to have a steady cash flow and the ability to keep making loan payments over that time. One way lenders determine affordability is by looking at your debt-to-income ratio . DTI compares your existing monthly debts with your monthly income. This shows how much money you have “left over” each month for a mortgage payment. The minimum mortgage loan amount for large banks might be $150,000 across the board.

This means that if you default on your loan, we’ll pay your lender up to 25% of the county loan limit minus the amount of your entitlement you’ve already used. Many homebuyers will simply have to keep looking until they find a better property that will meet FHA standards. This reality can be frustrating, especially for buyers with limited funds and limited properties in their price range. Requiring that the property meet minimum standards protects the lender.

The minimum is usually determined by the individual lender, but it can be 20 percent, 25 percent, 30 percent or more. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

FHA loan qualifications don’t usually require cash reserves unless you’re buying a two- to four-unit home or trying to qualify with a lower credit score. Most lenders have minimum amounts they are willing to lend via home equity loans. The interest rates on these loans are generally quite low and so lenders may not make a profit on small loans that the borrower pays back almost immediately. Most lenders have a minimum of $35,000 for a home equity loan, though some will go as low as $10,000.

If your CIBIL score is low and you wish to get approved for a Home Loan, you must convince your lender that you are entirely capable of repaying the loan. One of the best ways to do this is to show good income. If your CIBIL score is low, add all extra income sources, such as rental income, interest payments, money earned from a part-time job, etc. to your loan application.

Be sure to remember that home prices will be different in the future, too. So, 10 percent of the median home price today may not hit that mark in three years. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Comments

Post a Comment